Low Asset Deputyship Service

Providing Local Authoritys and Solicitors with Practical Solutions

Low Asset Deputyship Service

Money Carer has introduced a ‘low asset’ deputyship service to provide those people with small amounts of assets with access to a low-cost court of protection deputyship service to act on their behalf and in their best interests in line with the Mentals Capacity Act (2005).

The service has predominantly been designed to provide a much-needed deputyship solution for the well-documented problem of a shortage of organisations willing to take on the responsibility of becoming a court appointed deputy for clients with very low assets.

The main reason for the shortage of supply in deputyship solutions for people with smaller amounts of money to be accessed and managed is the restriction of fees that can be charged by the deputy. This means that many solicitors with court of protection departments that provide deputyships are simply unable to take on low asset referrals as they are financially unviable to the law firm. Equally, the resource constraints that many local authorities face also mean that many councils simply are unable to fill the gap due to their own workloads and budget restrictions.

As Money Carer have a much lower cost base and benefit from the operational efficiencies delivered by its proprietary money management platform (Monika) we are able to provide a robust deputyship service to support those vulnerable clients who require a professional deputy to provide the necessary for support them.

Deputyship Transfers and Relinquishments

Money Carer also works alongside existing deputies who may be assessing whether continuing as deputy is in the best interest of their client going forward.

In these cases, it may be more appropriate for an existing deputy to apply to the court of protection for a relinquishment decision if the clients assets and income have depleted. In this scenario, a deputyship is no longer the most appropriate plan to best serve the client in the future.

Money Carer can agree to inform the court formally – in conjunction with the relinquishment application – that we are willing and able to act as the individuals DWP appointee if that would be a more suitable and cost effective arrangement for the client. When assessing best interest, please refer to the OPG Professional Deputy Guide and Checklist.

JMW Solicitors LLP

A deputyship partner in focus

Money Carer has worked closely with the court of protection team at JMW Solicitors for almost 8 years.

JMW have ‘panel deputy’ accreditation with the OPG and are very experienced in all types of deputyship and deputyship court of protection matters. JMW have a particular expertise in working with local authorities across the UK in a similar way to Money Carer.

In fact, both organisations regularly pool resources in order to find the most appropriate solutions for clients and to support local authorities social services teams at the same time.

Our expertise

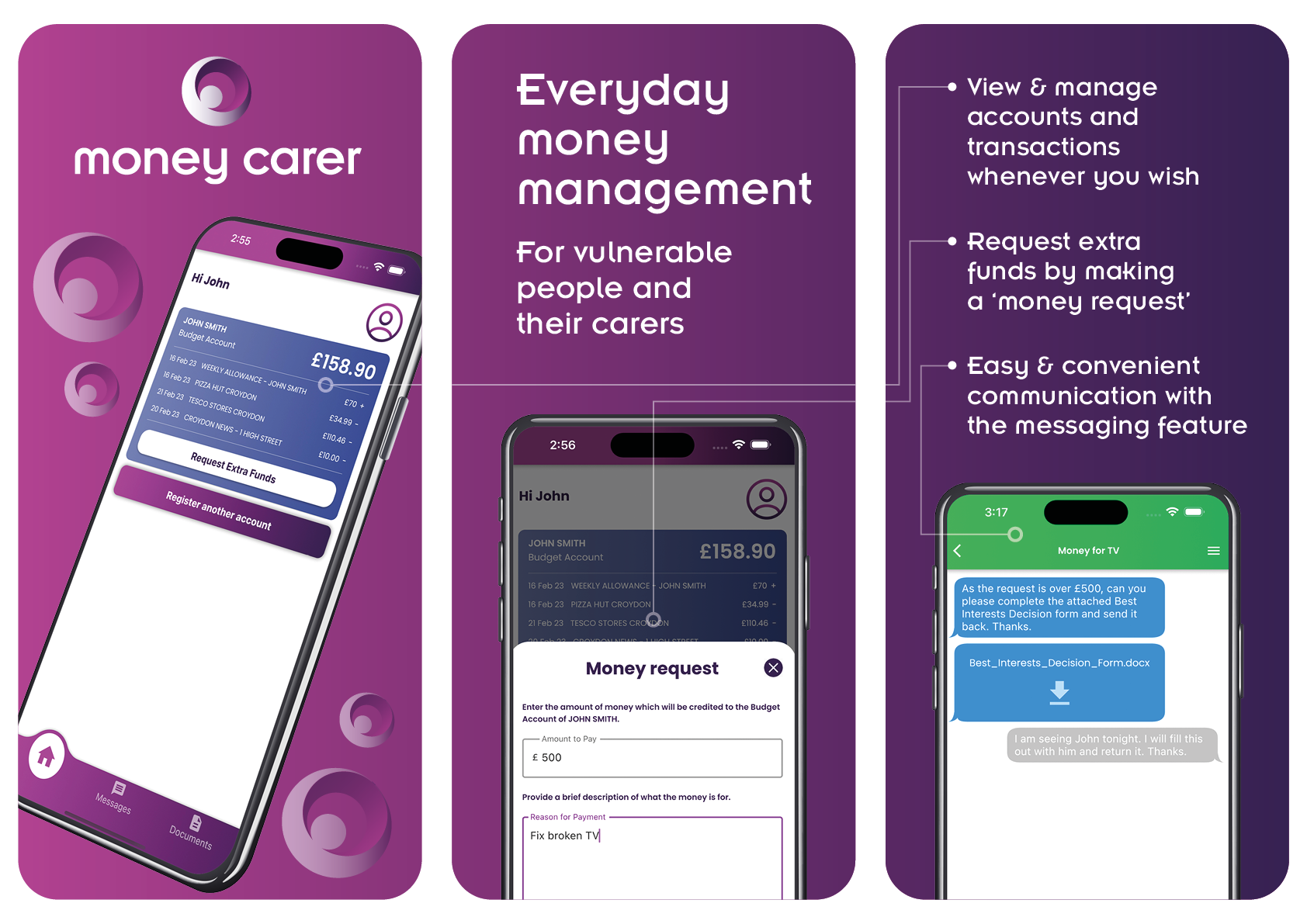

Our appointeeship services support people with differing care needs from all walks of life. We are the organisation that developed and brought to market the concept of carer cards, and we continue to invest in developing our proprietary banking and payments software. This allows us to provide innovative solutions to everyday money management problems experienced by our clients and their carers.

We harness our own resources and expertise to partner with local authorities and care providers that may be struggling or unable to provide money management services to vulnerable client groups.

We are a national partner to Department of Work & Pensions (DWP) and we work with in excess of 100 local authorities, circa 250 law firms and hundreds of care providers who use our services.

Deputyship Application FAQs

Who might need a deputy for property and finances?

A deputy for property and finances may be needed for individuals who are unable to manage their financial and property affairs due to various reasons such as age-related mental decline, illness, or disability. This could include:

- Elderly individuals who may have difficulty managing their finances and property due to declining mental and physical health.

- Individuals who have suffered a brain injury, stroke or other cognitive impairment which has affected their ability to make decisions about their financial and property matters.

- People with mental illnesses or disabilities which prevent them from managing their finances and property.

- Individuals with developmental disabilities who may require assistance in managing their finances and property.

In these situations, a deputy may be appointed by the court of protection to make decisions on behalf of the individual in relation to their property and finances. Find out more about health and welfare deputyship by contacting a member of our team.

Who can be a deputy for property and finances?

In general, anyone who is over the age of 18 and has the capacity to manage financial and property affairs can be appointed as a deputy for property and finances. However, it is important to note that being a deputy is a significant responsibility and requires a high level of trust and competence. Here are some common types of individuals who may be appointed as a deputy for property and finances:

- Family members or close friends: Often, family members or close friends of the person who needs assistance are appointed as deputies. They may have a good understanding of the person’s wishes and preferences and can act in their best interests.

- Professional deputies: If there are no suitable family members or friends, a professional deputy may be appointed. This could be a solicitor, accountant or other professional with experience in managing financial and property affairs.

- Local authorities: In some cases, a local authority may be appointed as a deputy for property and finances, particularly if there are concerns about abuse or neglect.

It is important to note that being a deputy for property and finances is a serious responsibility and requires a high level of trust and competence. Therefore, anyone who is appointed as a deputy should be able to demonstrate that they have the necessary skills and experience to manage the person’s affairs effectively and in their best interests. Find out more by reading the official deputyship guidance.

What are the responsibilities of a deputy?

When appointed as a deputy for property and finances, the deputy has a range of responsibilities that they must fulfil in order to act in the best interests of the person they are representing. These responsibilities include:

- Managing finances: The deputy is responsible for managing the person’s finances, which includes paying bills, managing bank accounts, investing funds, and ensuring that the person’s financial affairs are in order.

- Making decisions: The deputy must make decisions on behalf of the person in relation to their finances and property, taking into account the person’s wishes, beliefs, and values. The deputy must act in the person’s best interests and ensure that any decisions made are in line with the principles of the Mental Capacity Act 2005.

- Keeping records: The deputy must keep accurate and up-to-date records of all financial transactions and decisions made on behalf of the person. This includes keeping receipts, invoices, bank statements, and other financial documents.

- Reporting to the Office of the Public Guardian (OPG): The deputy must submit an annual report to the OPG, which provides details of all financial transactions and decisions made on behalf of the person. The report must be reviewed by a solicitor or other professional, and any discrepancies or concerns must be addressed.

- Consulting with others: The deputy should consult with the person’s family, friends, and carers to ensure that decisions made are in line with the person’s wishes and preferences.

- Seeking professional advice: The deputy should seek professional advice when needed, such as from a solicitor or accountant, to ensure that they are fulfilling their responsibilities effectively.

Can a deputyship be temporary?

Yes, a deputyship can be temporary. In the UK, the Court of Protection can appoint a deputy for a fixed period of time if it is deemed necessary. This is known as a “limited deputyship” and may be appropriate in situations where the person is expected to regain capacity in the near future. For example, if an individual is undergoing medical treatment or therapy that is expected to improve their mental capacity within a set period of time, a limited deputyship may be appropriate. In this case, the deputy would be appointed for a fixed period of time and would have the authority to make decisions on behalf of the person during that period.

It is important to note that a limited deputyship may not be appropriate in all cases, and the court will consider all the evidence before making a decision on whether to grant a limited deputyship or a permanent deputyship. In general, a permanent deputyship is more commonly granted when the person’s capacity is unlikely to improve, or if there are ongoing concerns about their ability to manage their financial and property affairs.

What are the costs involved in applying to be a deputy for property and affairs?

If you are applying to be a Deputy for Property and Affairs for someone who lacks the capacity to manage their own finances, there are several costs involved, which may include:

- The Application fee:

There is a one-time application fee to become a deputy, which is currently £371 in England and Wales. This fee covers the cost of processing your application.

- An Assessment fee:

In addition to the application fee, you may also need to pay an assessment fee for a medical professional to assess the capacity of the person you wish to become a deputy for. This fee can vary depending on the healthcare professional you choose.

- The Security Bond fee:

If you are appointed as a deputy, you may be required to pay a bond fee. The bond fee is a type of insurance that ensures the person’s finances are protected from any misuse or mishandling by the deputy. The cost of the bond fee can vary depending on the size of the person’s estate and the level of risk involved.

- Ongoing fees:

Once appointed as a deputy, there may be ongoing fees to pay for things like annual supervision and filing annual reports with the Court of Protection. These fees can vary depending on the complexity of the person’s estate and the level of supervision required.

It’s worth noting that if the person you wish to become a deputy for is on a low income, they may be eligible for help with the application fee and assessment fee. Please contact a member of our team to find out more about the deputyship application process.